Market Entry Case - M&A

- Baran Oguz

- M&A

- 04 Mar, 2024

As the leader of a merger and acquisition (M&A) initiative, my role was to spearhead the in-depth analysis of a specific region where our company—a multi-billion-dollar market value enterprise—aimed to establish a stronger presence. Our exploration was geared toward determining the most strategic path to enter this region, be it through the acquisition of a company or exploring other viable alternatives. This paper delves into the comprehensive process we undertook, outlining the steps, strategies, and insights gained as we navigated through this ambitious project.

This table outlines a comprehensive summary of the strategic steps undertaken in our initiative. The process was meticulously designed to explore and evaluate the potential for establishing a stronger presence within a targeted region. Each step was integral to developing an informed, strategic approach to market entry, whether through acquisitions, partnerships, or other means. Below is a detailed overview of the phases involved in our initiative:

| Step | Activity | Description |

|---|---|---|

| 1 | Market Analysis | Conducted an in-depth analysis of the market size to determine attractiveness, including potential for capturing market share, understanding competitive dynamics, and assessing the general market environment. |

| 2 | Engaging SMEs and Conducting a Workshop | Involved collaborating with subject matter experts to facilitate knowledge sharing and gather additional information essential for making informed strategic decisions. |

| 3 | Entry Strategy Development | Evaluated potential market entry strategies, including direct establishment, joint ventures, partnerships, or acquisitions, considering the pros and cons of each approach based on the market and competitive analysis. |

| 4 | Potential Acquisition or Partnership Identification | Identified companies within the targeted market segment that aligned with our strategic goals, considering factors such as market position, financial health, and cultural fit. |

| 5 | Detailed Financial and Operational Assessment Process | Conducted a preliminary financial and operational assessment of identified potential targets to evaluate their viability, including a review of financial performance, market reputation, operational efficiencies, and potential synergies. |

| 6 | Scoring Model Application | Employed a scoring model to systematically evaluate potential targets based on predefined criteria, including financial stability, strategic alignment, cultural compatibility, and potential for integration. |

| 7 | Strategy Formulation for Engagement | Based on the scoring model's outcome, formulated a strategy for engaging with top-ranked companies, planning for initial discussions, negotiations, and potential deal structuring |

| 8 | Engagement and Negotiation | Initiated dialogue with selected potential targets to explore opportunities for acquisition or partnership, entering into negotiations based on a clear understanding of our strategic objectives and the value proposition for both parties. |

Following the high-level overview of our project's execution phases, we're set to dive into the details of our work. Next, we'll delve into what we did and how we did it, showcasing the specific actions and considerations that shaped our project. Join us as we examine these elements more closely.

1. Market Analysis

The Market Analysis phase was crucial for our strategic decision-making process, aiming to conduct a comprehensive evaluation of market size, growth prospects, and overall attractiveness. This foundational analysis was challenging due to limited data availability, necessitating the development of our database to evaluate ongoing projects, potential future projects (growth rate), and various factors such as demographics, economic conditions, and geography. Below is an illustration of our goal, which was to estimate the market size.

1.1 Assessment of Market Size and Growth

Our initial step involved aggregating and analyzing data from diverse sources, such as industry and government reports, market research, and economic indicators. To augment this effort, we developed a comprehensive project database that catalogued ongoing and upcoming projects up to the year 2030. This database not only facilitated a more accurate quantification of the market's current size but also offered insights into its growth trajectory, establishing a solid baseline for the market's capacity and potential for expansion. The objective was to utilize this detailed illustration to determine the market's attractiveness for further analysis. Following this assessment, we aimed to strategically segment the market.

Main activities

- Data Aggregation: Collecting data from a wide range of sources, including industry reports, government publications, market research studies, and economic indicators, alongside meticulously compiling a database of current and future projects within the market.

- Comprehensive Project Database Creation: Developing an extensive database of ongoing and forthcoming projects until 2030, detailing each project's scope, estimated value, and timeline. This database became a pivotal tool for understanding the market size more accurately and identifying potential projects for our entry.

- Data Analysis: Analyzing the gathered data alongside the project database to discern historical trends, ascertain the current market size, and forecast future growth. This analysis took into account the detailed insights provided by the project database, enriching our understanding of the market dynamics.

- Market Quantification: Leveraging quantitative data derived from both traditional sources and the newly created project database to calculate the market's current size, providing a more nuanced view of available and upcoming market opportunities.

- Growth Forecasting: Utilizing the comprehensive insights from the project database to project the market's growth trajectory more precisely, considering not only historical data and economic indicators but also the pipeline of known projects extending to 2030.

1.2 Target Market Segmentation

We methodically segmented the market to understand its composition in finer detail, quantifying the size of each segment. This strategic division allowed us to identify and assess the segments with the greatest potential for our entry. By evaluating our strengths relative to each segment, we pinpointed where we could competitively position ourselves and effectively leverage our capabilities. This process was instrumental in revealing the segments that not only align with our strategic goals but also hold the most significant potential for growth and success. Below is an illustration of the market segmentation.

Main activities

- Market Breakdown: Dividing the broader market into smaller, more manageable segments based on specific criteria.

- Segment Size Quantification: Measuring the size of each identified market segment to determine its relative scale and potential within the broader market.

- Potential Assessment: Evaluating the potential of each segment for market entry, considering factors such as growth rate, profitability, and accessibility.

- Strengths and Opportunities Analysis: Assessing our company's strengths and how they match up with the opportunities present in each segment, identifying where we have a competitive advantage.

- Strategic Positioning: Determining the optimal segments for entry where our company's unique capabilities can be most effectively utilized and where we can achieve a sustainable competitive position.

- Alignment with Strategic Goals: Ensuring the identified segments are in harmony with our company's broader strategic ambitions, prioritizing those that offer the most significant opportunities for growth and achievement.

- Segment Prioritization: Prioritizing the segments based on their attractiveness and our ability to succeed, focusing resources on those with the greatest potential for positive impact.

1.3 Evaluation of Market Attractiveness

To gauge the market's attractiveness, our assessment transcended basic dimensions of size and growth rates. We undertook a comprehensive investigation of consumer trends and demand patterns, which helped us identify key opportunities for market penetration or expansion. Simultaneously, we conducted an in-depth examination of industry profitability. This involved a focus on average margins and cost structures, enabling us to determine the financial viability of entering the market. This multifaceted approach ensured a well-rounded understanding of the market's potential.

Main activities

Consumer Trends Analysis:

- Conducting research to understand current and emerging consumer behaviors, preferences, and trends.

- Identifying shifts in consumer demand that could signal new opportunities for market penetration or expansion.

Profitability Assessment:

- Analyzing the industry's overall profitability, including the examination of average profit margins and cost structures.

- Assessing the financial viability and potential returns of entering the market, based on existing industry economic models.

1.5 Competitive Dynamics

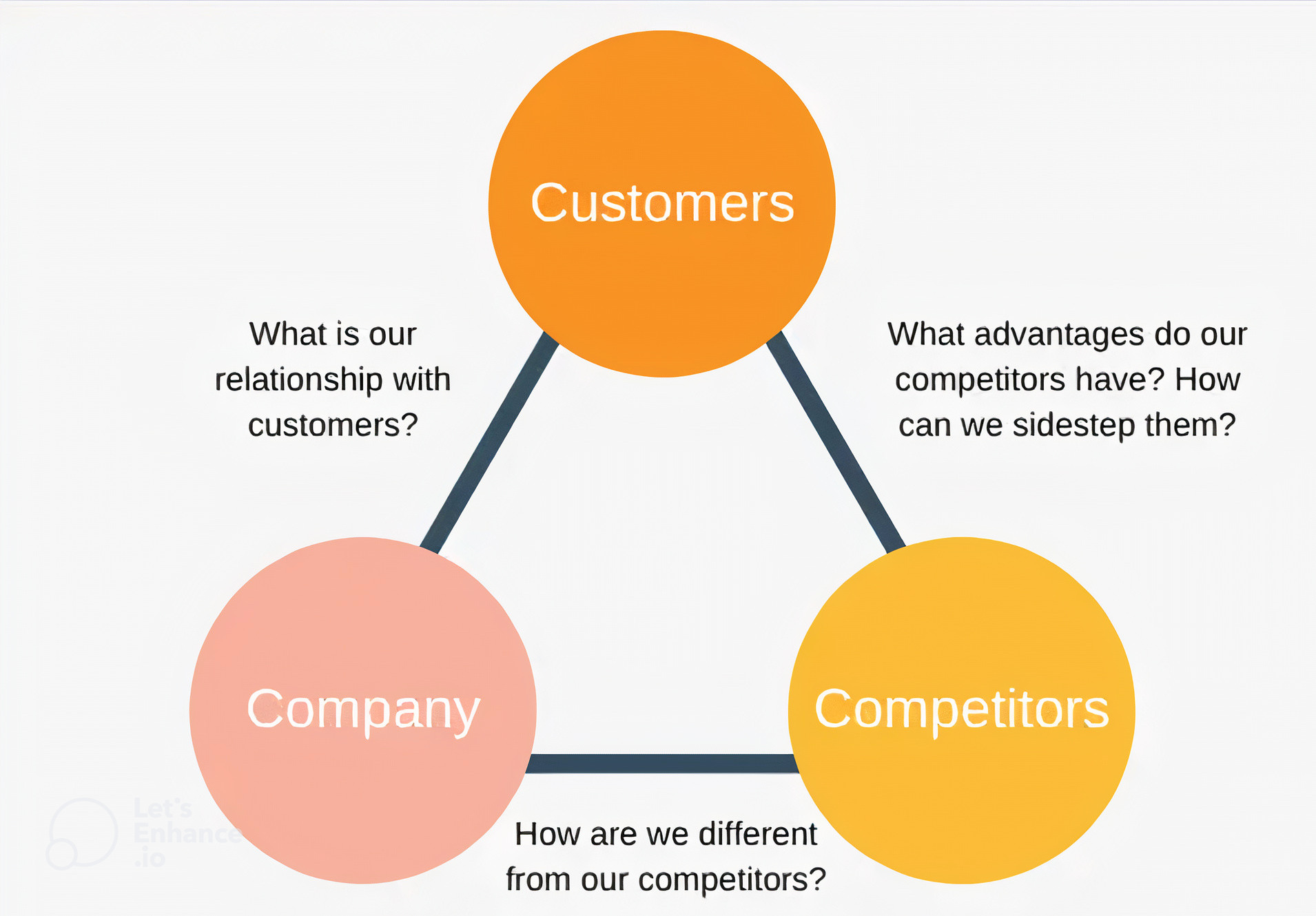

A thorough understanding of the competitive landscape was vital to gauge our ability to establish a market presence. This involved identifying principal competitors, analyzing their market shares and strategic positions to assess market concentration and competition intensity.

Main activities

- Identifying Principal Competitors: Conducting a detailed mapping of key players in the market to understand their roles, strengths, and weaknesses.

- Market Share Analysis: Analyzing the market shares of these competitors to assess the market's concentration and the intensity of competition, providing insights into the market's competitive balance.

- Strategic Position Evaluation: Examining the strategic positions of principal competitors, including their market focus, target customer segments, product offerings, and competitive advantages.

- Competition Intensity Assessment: Evaluating the intensity of competition by looking at the number of competitors, the diversity of their strategies, and the aggressiveness of their market behaviors.

- Trend Observation: Observing trends in competitive strategies, such as shifts towards digital transformation, sustainability practices, or customer experience enhancements, to anticipate future competitive moves.

- SWOT Analysis: For each principal competitor, conducting a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis to uncover potential competitive advantages and vulnerabilities that could impact our market entry strategy.

- Benchmarking: Comparing our company's offerings, capabilities, and strategies against those of identified competitors to pinpoint areas for improvement and opportunities for differentiation.

The frameworks employed include the 3C's model, Porter's Five Forces, and SWOT analysis.

An illustration of this process

An illustration of this process

1.6 General Market Environment Assessment

We conducted an exhaustive review of the broader market environment, covering regulatory, technological, and socio-economic factors. This comprehensive perspective was instrumental in recognizing external influences that could affect market entry and success, including:

- Regulatory challenges and compliance demands that might constitute entry barriers.

- Technological developments presenting opportunities for market innovation and differentiation.

- Geographic analysis, including the region's layout, distances between cities, and available transportation options like buses, trains, and flights, along with airport connections.

- Demographic studies of the population, birth and death rates, and growth trends in the region's cities.

- Examination of educational infrastructure, including the presence of universities and schools, their quality, and the implications for the region's talent pool.

- Analysis of social activities in the region, contributing to an understanding of the local lifestyle and community engagement.

- Evaluation of the local job market, focusing on worker availability, education levels, and employment trends.

The framework employed includes PESTEL analysis.

The accompanying illustration represents our conceptualization of the business landscape. It encapsulates both the supply and demand sides, illustrating the exchange of products or services within this market. Additionally, this landscape is influenced by various external factors, including technological advancements and political dynamics.

2. Engaging SMEs and Conducting a Workshop

2.1 Engaging SMEs and External Advisors:

Initial Presentation and Detailing: Following our comprehensive market analysis, we initiated the engagement process by presenting our findings to Subject Matter Experts (SMEs) within our company and external advisors. This presentation aimed to provide a deep dive into the market's intricacies, offering a detailed understanding of the current landscape, growth prospects, and competitive dynamics.

Interview Preparation and Execution:

- Building on the insights shared during the presentation, we proceeded to meticulously prepare interview materials tailored to extract domain-specific insights from the SMEs. This preparation involved formulating targeted questions that would elicit detailed responses on various aspects of the market.

- We extended invitations to selected SMEs who are recognized experts in their fields, ensuring a broad and comprehensive perspective on the market and potential strategies.

2.2 Planning and Executing a Workshop:

Objective and Structure:

- The feedback and insights garnered from the SME interviews laid the groundwork for planning an interactive workshop. The primary objective of this workshop was to collaboratively explore strategic options concerning market segments, target customers, potential partners, and acquisition candidates.

- We aimed for the workshop to be dynamic and participatory, encouraging open discussion on key strategic considerations such as acquisition targets, forms of establishment, and critical factors in the acquisition process.

Activities and Tools:

- The workshop incorporated a variety of exercises designed to stimulate strategic thinking and analysis. These included custom exercises developed specifically for our strategic objectives, as well as established tools like SWOT analysis, Strategy Diamond framework and own defined tool. Example is below.

2.3 Outcome and Next Steps

Collaborative Insights and Strategic Alignment: The interactive nature of the workshop fostered a rich exchange of ideas and perspectives, enabling the consolidation of collective insights into a coherent strategic vision. Discussions on the preferred forms of establishment, acquisition considerations, and partner strategies were particularly fruitful, highlighting consensus areas and potential challenges.

Action Plan Development: Building on the workshop's outcomes, we developed a detailed action plan outlining the next steps in our market entry strategy. This plan prioritized market segments and target customers, identified key partners and acquisition targets, and detailed the strategic rationale for each choice.

3. Entry Strategy Development Process

In the Entry Strategy Development phase, we undertook a critical evaluation of the various pathways available for market entry. This step was pivotal in shaping our approach to establishing a presence in the targeted market, informed by the insights gained from our comprehensive market and competitive analyses. Here’s a detailed breakdown of what we did.

Strategic Evaluation of Entry Modes: Our first task was to outline the potential market entry strategies. This included:

- Direct establishment,

- Joint ventures

- Partnerships

- Acquisitions.

Each strategy was identified as a viable option based on initial market insights.

Analysis of Pros and Cons: For each potential entry mode, we conducted an in-depth analysis to weigh its advantages and disadvantages. This involved considering factors such as the level of market control, resource commitment, risk exposure, and speed to market that each strategy entailed.

- Direct Establishment was evaluated for its potential to provide full control over operations but recognized for the significant investment and higher risk it requires.

- Joint Ventures and Partnerships were considered for their benefits in risk-sharing, local market knowledge, and quicker access to the market, against challenges in aligning objectives and profit sharing.

- Acquisitions were assessed for the immediate market presence and access to established resources they offer, balanced against the complexities of integration and higher upfront costs.

Integration with Market and Competitive Insights: The pros and cons analysis was further refined by integrating specific insights from our market analysis, such as market size, growth potential, and segment attractiveness, and our competitive analysis, which provided an understanding of the competitive landscape and potential barriers to entry.

Scenario Planning and Risk Assessment: We employed scenario planning to envision how each entry strategy might unfold within the current market and competitive context. This helped us assess the feasibility and potential risks associated with each strategy, taking into account possible market changes, competitive reactions, and regulatory developments.

Strategic Decision Making: Armed with a comprehensive understanding of the implications of each market entry strategy, we engaged in strategic decision-making. This process was collaborative, involving key stakeholders to ensure alignment with our overall business objectives and strategic goals.

4. Potential Acquisition Identification Process

The step focusing on potential acquisitions was a critical component of our market entry strategy, aimed at identifying companies within the targeted market segment that not only aligned with our strategic goals but also represented viable opportunities for successful integration and growth. Here’s how we approached this crucial phase:

Identification of Target Companies: Utilizing the insights gained from our previous analyses, we began by shortlisting companies within the targeted market segment that exhibited characteristics aligning with our strategic objectives. This initial list was generated based on a range of criteria including market presence, innovation capabilities, and potential for synergistic integration.

Evaluation Criteria Development: To ensure a structured and objective evaluation, we developed a set of criteria against which potential acquisition targets were assessed. These criteria included:

- Market Position: The company’s standing within the market, its brand reputation, customer base, and market share.

- Financial Health: An assessment of the company's financial stability, profitability, revenue growth trends, and financial risks.

- Cultural Fit: The compatibility of organizational cultures, values, and business practices, which is essential for seamless integration and minimizing post-acquisition challenges.

Moreover, our assessment extended beyond these core criteria to encompass other vital dimensions.

Comprehensive Due Diligence: For companies that met our initial criteria, we conducted a thorough due diligence process. This involved deep dives into their financial records, operational efficiencies, legal obligations, and any potential liabilities. The aim was to uncover any hidden risks or opportunities that could affect the acquisition's success.

Strategic Alignment Assessment: Beyond the operational and financial assessments, we evaluated how each potential acquisition could contribute to our strategic goals. This included considerations of how the acquisition could enhance our product offerings, expand our market reach, or strengthen our competitive positioning.

Cultural Compatibility Evaluation: Recognizing the importance of cultural alignment for the success of any acquisition, we invested significant effort in understanding the organizational culture of potential targets. This involved engagements with their leadership teams and, where possible, broader interactions with their employees to gauge the cultural dynamics at play.

Engagement with Potential Targets: Upon completing our evaluations and identifying the most promising acquisition candidates, we initiated discreet engagement with these companies to explore their openness to acquisition discussions. This step was approached with sensitivity and confidentiality to maintain the integrity of the process and relationships.c

5. Detailed Financial and Operational Assessment Process

The Financial and Operational Assessment Process served as a critical deep dive into the financial stability, operational efficacy, and strategic alignment of potential acquisition targets. Tailored to our strategic needs, this thorough evaluation was designed to uncover essential insights into the candidates, ensuring any potential acquisition would align with our long-term objectives and enhance our operational framework.

Initial Review: We began with an initial review, focusing on understanding the fundamental financial health and operational capabilities of each potential target. This early assessment provided a preliminary indication of their suitability and strategic fit with our objectives.

Detailed Financial Examination: A comprehensive examination of financial records was conducted to assess:

- Revenue and Profitability: Trends in revenue, profitability margins, and cash flow to evaluate financial stability and growth prospects.

- Financial Liabilities: Levels of debt and ongoing financial obligations to gauge financial risk and sustainability.

- Growth Investment: Capital expenditures and investments in innovation or development projects to understand the company's commitment to future growth.

Market Position Analysis: In our Market Position Analysis, evaluating the market position and reputation of each candidate was pivotal. This comprehensive process involved analyzing the brand strength, customer loyalty, and competitive positioning within key market segments. Simultaneously, we gathered insights from various sources, including public reviews, customer feedback, and industry analyses. This approach was instrumental in assessing each candidate's market reputation and reliability, offering a nuanced perspective of their standing in the competitive landscape.

Operational Review: Our assessment of operational efficiencies and capabilities covered:

- Process and Execution: Efficiency of project management, scheduling, and operational execution.

- Supply Chain Management: Evaluation of supply chain logistics, including the robustness of supplier relationships and materials sourcing strategies.

- Technological Adoption: Use of technology in operational processes, including project management tools, design software, or proprietary operational systems.

Synergy Exploration: Identifying potential synergies that could be realized post-acquisition was a key focus, looking at:

- Opportunities for cost reduction through operational integration or achieving economies of scale.

- Potential for revenue enhancement through market expansion, service diversification, and strategic market positioning.

- Strategic advantages from combining expertise, technologies, and intellectual assets.

Risk Analysis and Strategy Development: A thorough risk analysis aimed to identify potential legal, regulatory, or integration challenges, with strategic planning undertaken to mitigate these risks effectively.

Final Reporting and Recommendations: The process culminated in a detailed report summarizing the findings of the financial and operational assessment. This report provided a comprehensive overview of each target's financial health, operational strengths, market position, and potential strategic value, leading to informed recommendations for further action.

6. Scoring Model Application

Following the comprehensive analysis conducted in the earlier phases, we were in a position to apply our proprietary scoring model, specifically designed to assess the alignment and viability of potential targets. This model, crafted around key areas pivotal to our strategic objectives, enabled us to systematically evaluate each candidate. While the specifics of our scoring criteria remain confidential, the model incorporates essential factors such as financial stability, strategic fit, cultural compatibility, and integration potential, ensuring a holistic assessment of each potential target.

7. Strategy Formulation for Engagement Process

The Strategy Formulation for Engagement phase was a pivotal step in our acquisition strategy, focused on crafting a tailored approach to initiate engagement with the most promising acquisition targets. This process was guided by the outcomes of our comprehensive scoring model, which ranked potential targets based on their alignment with our strategic goals, financial health, and operational synergies. Here's how we approached this critical phase:

Analysis of Scoring Model Outcomes:

- We began by thoroughly analyzing the results from our scoring model, which provided a quantitative assessment of each potential target's suitability based on predefined criteria.

- This analysis helped us prioritize targets that not only aligned with our strategic objectives but also offered the greatest potential for value creation and successful integration.

Development of Engagement Strategies: In the Development of Engagement Strategies phase, we leveraged our clear understanding of top-ranking companies to craft bespoke strategies for initiating contact and engagement. This stage involved meticulous planning for initial discussions, where we focused on organizing the logistics and content of these conversations. Our aim was to clearly convey our intent, articulate the mutual benefits of a potential partnership or acquisition, and share our vision for a combined future. This strategic approach was essential in setting the stage for successful initial interactions and laying the groundwork for prospective collaborations.

Negotiation Preparation: In the Negotiation Preparation phase, we undertook a critical component that was foundational to our strategy. This involved strategic positioning, where we identified key value propositions and negotiation levers, leveraging the insights gained from our in-depth analysis during the due diligence and assessment phases. Additionally, we engaged in comprehensive scenario planning. This entailed anticipating potential responses and counteroffers from target companies and preparing strategic responses for various negotiation scenarios. This meticulous preparation was instrumental in equipping us with the agility and foresight needed for successful negotiation outcomes.

Deal Structuring Considerations: In the phase of Deal Structuring Considerations, our focus shifted towards preliminary planning for potential deal structures. This process included comprehensive financial modeling, where we developed detailed financial models to understand how various deal structures might affect our financial statements and overall valuation. Alongside this, we placed significant emphasis on integration planning. This involved considering how different deal structures would influence the ease of integration, operational synergies, and the alignment of cultures between our organization and potential partners. This dual approach ensured that we were not only financially prepared but also strategically aligned for the integration process post-deal.

Stakeholder Engagement: Prior to initiating contact with targets, we engaged with key internal stakeholders to align on the approach, ensuring that our engagement strategy had broad support and was in line with overall corporate objectives.

8.Engagement and Negotiation Strategy

In the Engagement and Negotiation phase, we embarked on a critical path toward actualizing our strategic plans, initiating meaningful dialogues with meticulously selected potential targets. This stage was pivotal for exploring viable opportunities for acquisitions or forming strategic partnerships, grounded in a mutual understanding of our overarching strategic objectives and the inherent value proposition for both involved entities. Here’s a closer look at how this phase unfolded:

Initiating Constructive Dialogue:

- We proactively reached out to carefully chosen targets, those whose strategic goals and market positions showed alignment with our long-term vision. The initiation of these conversations was strategically planned to ensure transparency and set the tone for constructive dialogue.

- The aim was to clearly communicate our interest in exploring collaborative opportunities, underlining the strategic and operational synergies that could be unlocked through a partnership or acquisition.

Articulating the Value Proposition:

- A cornerstone of our negotiation strategy was the articulation of a compelling value proposition, detailing the strategic and operational benefits for the potential partner. This encompassed enhancing their competitive edge, broadening market access, and fostering innovation through collaborative efforts.

- We underscored the strategic alignment and potential for shared success, emphasizing how a combined entity could achieve more significant market influence and operational efficiency.

Synergy Exploration:

- Negotiations provided a platform to explore and articulate the synergies that an acquisition or partnership would bring. We delved into how such synergies could drive operational efficiencies, enhance service or product portfolios, and solidify our market standing.

- Illustrating the practical benefits of collaboration, we aimed to forge a shared vision for the future, highlighting the incremental value achievable through our union.

Collaborative Negotiation Process:

- We adopted an iterative and collaborative approach to negotiations, fostering an environment conducive to open exchange and flexible problem-solving. This methodology enabled the exploration of various structuring options and terms to align with the mutual goals of both parties.

- Our focus remained steadfast on securing an equitable outcome that would serve as a foundation for a prosperous and integrated future, ensuring that any agreement reached was in the best interest of both entities.

Achieving Consensus:

- Progressing toward a consensus, we concentrated on finalizing deal terms that reflected fairness and strategic congruence. Discussions on valuation, integration strategies, and post-acquisition operations were approached with meticulous attention to detail and a commitment to achieving a balanced agreement.

- Following the attainment of a preliminary understanding, concerted efforts were directed toward drafting, reviewing, and finalizing formal agreements, meticulously addressing all pertinent legal, financial, and operational details.

Wrapping Up: Thoughts and Thanks

As we come to the end of this post, I want to extend my heartfelt gratitude to you for taking the time to read through this post.

If the insights and experiences shared in this post resonated with you, or if you have any thoughts, experiences, or questions of your own, I warmly encourage you to take contact with me. Your perspectives are highly appreciated.